Opportunity Zones

Opportunity Zones are a community development program established by the United States Congress as a part of the Tax Cuts and Jobs Act of 2017. Designed to encourage long-term private investments in low-income communities, the program provides a federal tax incentive for taxpayers who reinvest unrealized capital gains into “Opportunity Funds,” which are specialized vehicles dedicated to investing in low-income areas called “Opportunity Zones.”

Designated zones are to be comprised of low-income community census tracts and designated by governors in every state. Approximately 24% (212 out of 901) of eligible tracts within the Commonwealth of Virginia received this designation in April 2018. The final designated Opportunity Zones also reflect proportionality at the GO Virginia region, Economic Development Organization sub-region and at the locality levels.

More information is available at Treasury.gov and IRS.gov.

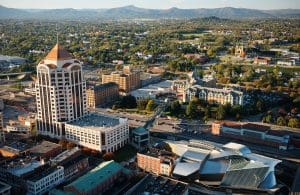

Where are the Opportunity Zones located in the City of Roanoke?

- Census Tract 12 Roanoke City, Virginia

- Census Tract 6.01 Roanoke City, Virginia

- Census Tract 11 Roanoke City, Virginia

- Census Tract 6.02 Roanoke City, Virginia

Parcels located within Opportunity Zones

What are the incentives that encourage long-term investment in low-income communities?

The Opportunity Zones program offers investors the following incentives for putting their capital to work in low-income communities:

- Investors can roll existing capital gains into Opportunity Funds with no up-front tax bill.

- A 5 year holding increases the rolled-over capital gains basis by 10%

- A 7 year holding increases the rolled-over capital gain investment basis 5% for a total of 15%

- Investors can defer their original tax bill until December 31, 2026 at the latest, or until they sell their Opportunity Fund investments, if earlier.

- Opportunity fund investments held in the fund for at least 10 years are not taxed for capital gains.

Additional Resources:

- Virginia Department of Housing and Community Development

- U.S. Department of the Treasury: Community Development Financial Institutions Fund (CDFI)

- U.S. Internal Revenue Service: Frequently Asked Questions

- U.S. IRS Revenue Procedure

- Tax Cuts and Job Act of 2017

- The Roanoke Regional Partnership recently completed a prospectus on the Opportunity Zones in our region. Click here for more information.